Right of Use Asset Ifrs 16

The Right-Of-Use asset in IFRS 16. Jennifer has over 16 years of experience in audit and technical accounting.

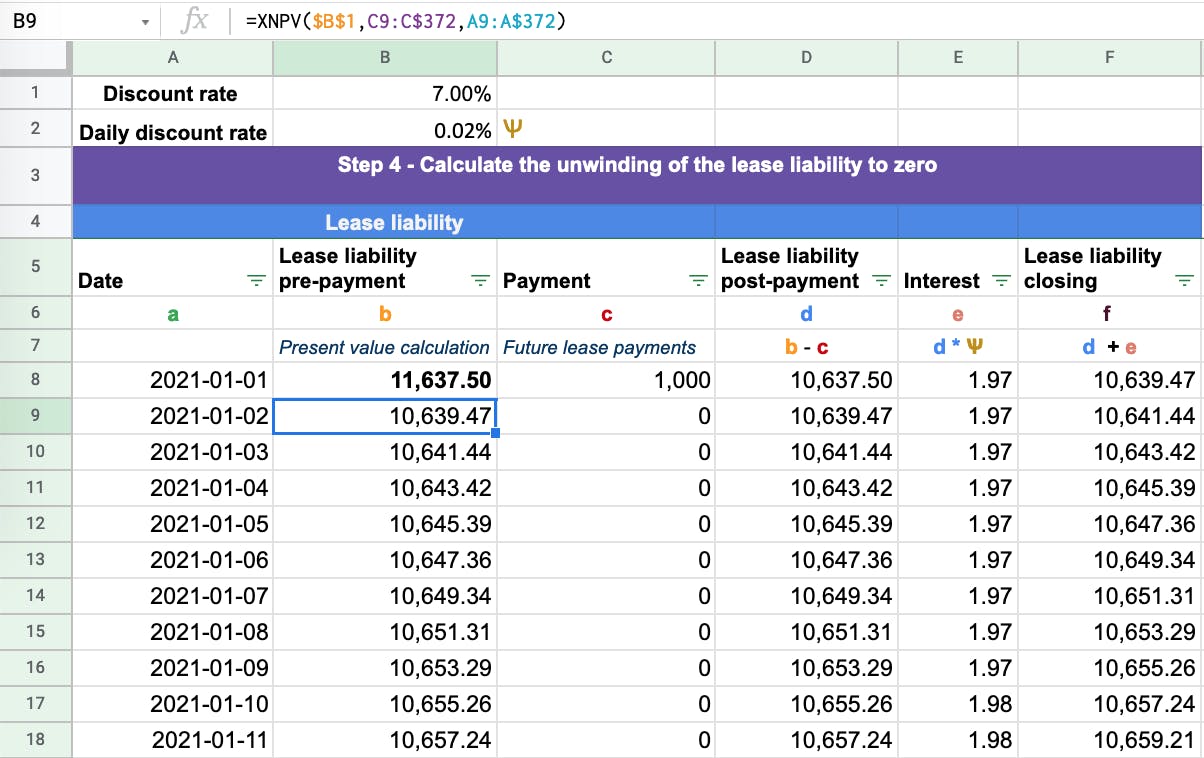

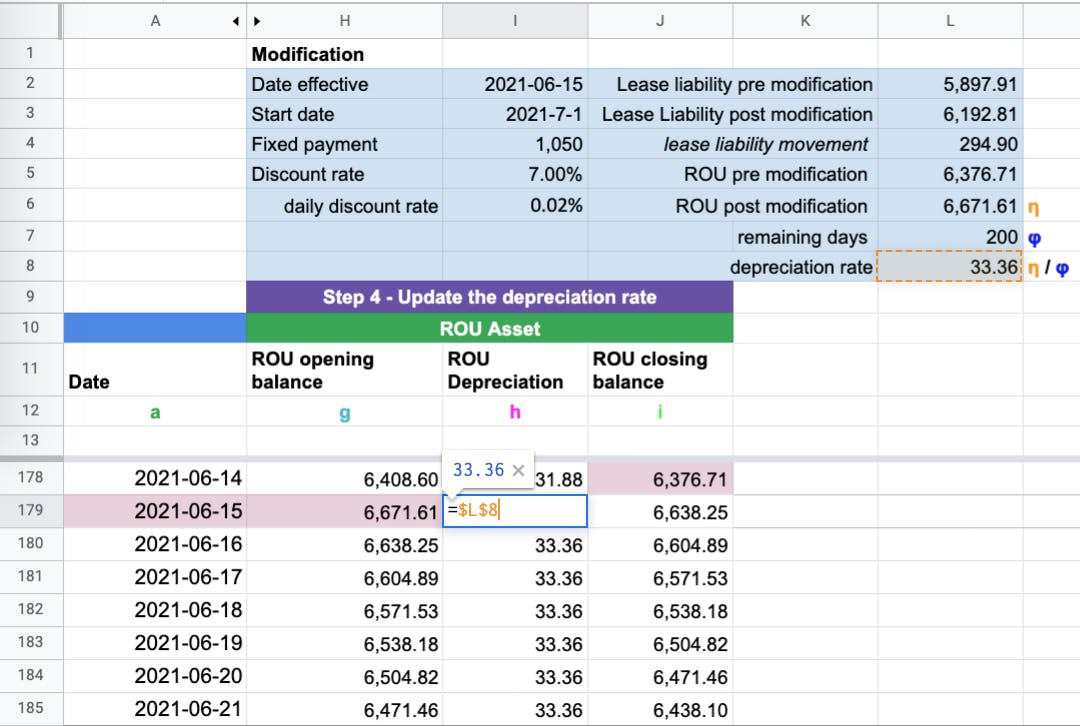

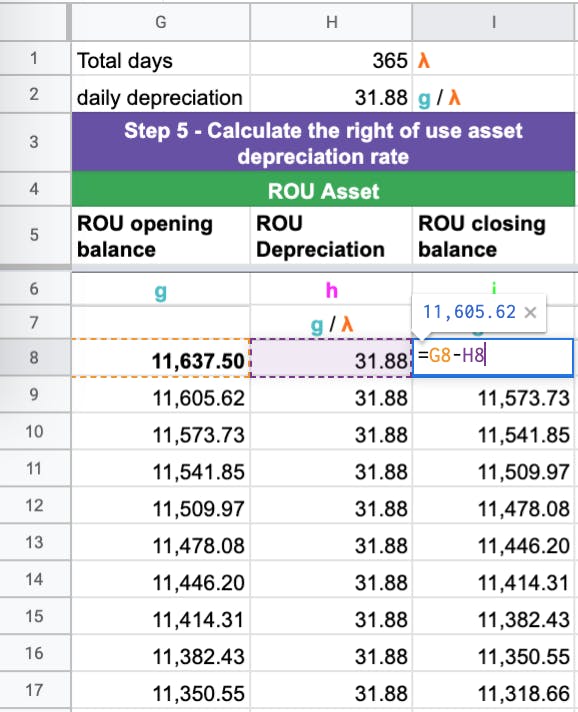

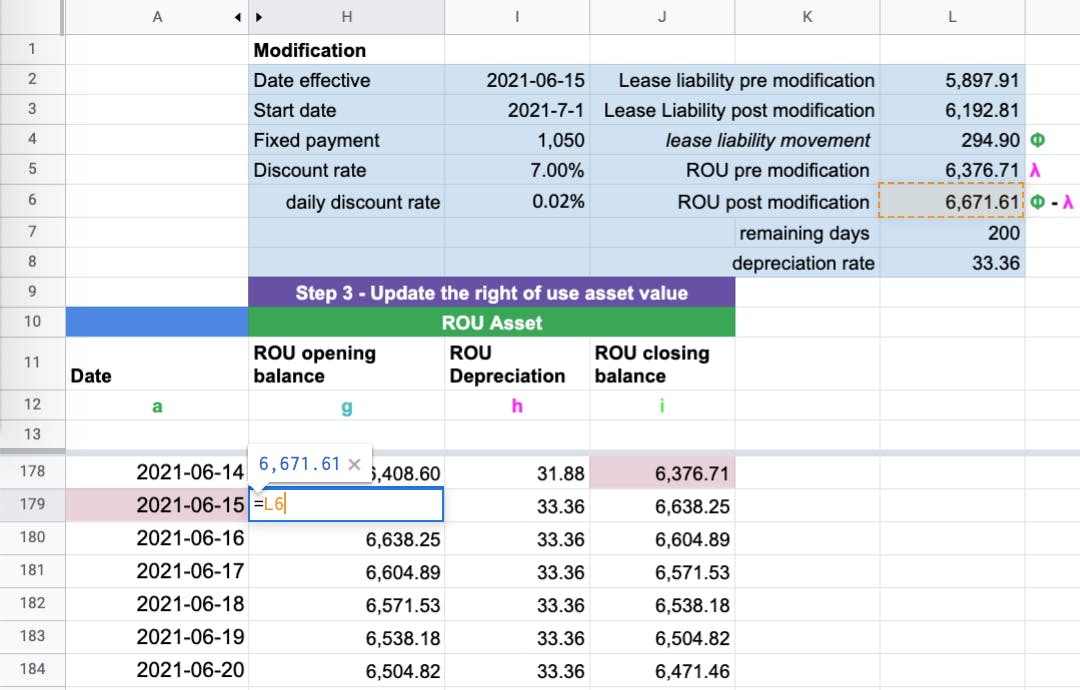

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Initial lease liability Plus.

. Identifying the IFRS 16 presentation and disclosure requirements and providing a series of examples illustrating one possible way they might be presented. The right-of-use asset. Jennifer has over 16 years of experience in audit and technical accounting.

Here are the steps to calculate this. IFRS 16 is the new lease standard. Debit Right of Use Asset Depreciation 92683.

A classification distinction between operating and finance leases does not exist under IFRS 16. The cash flow forecast and. Initial right-of-use asset equals to.

Ii the right-of-use asset relates to a class of PPE to which the lessee applies IAS 16s revaluation model in which case all right-of-use assets relating to that class of PPE can. If we look at the definition of cost within IFRS 16 this means that the initial measurement of the right-of-use asset is calculated as follows. This journal entry should be entered on a monthly basis.

Elements to consider include. IFRS 16 Leases in the statement of cash flows IAS 7 On 1 January 20X4 ABC entered into the lease contract. IFRS 16 may impact both a CGUs carrying amount and the way the recoverable amount of the CGU is measured.

The details are as follows. IFRS 16 defines a lease as A contract or part of a contract that conveys the right to use an asset for a period of time in exchange for consideration. IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months unless the underlying asset is.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. The objective of IFRS 16 is to report information that. From the commencement date onwards the cost model should be applied in measuring the right-of-use.

Under Appendix A of IFRS 16 a lease is de昀椀ned as a contract or part of a contract that conveys the right to use the underlying asset for a. A right-of-use asset and lease liability interest expense on the lease liability depreciation expense. Right-of-use asset under IFRS 16.

Rather a single model approach is applied. For a lessee a lease that is accounted for under IFRS 16 results in the recognition of. Impairments are applicable to both tangible and intangible assets including property plant equipment goodwill software or right-of-use ROU assets.

Credit Right of Use Asset Accumulated Depreciation 92683. Remeasurements of the lease liability are treated as adjustments to the right-of-use asset. The new leases standard IFRS 16 Leases applies to annual periods beginning on or after 1 January 2018 so.

IFRS 16 Leases brings along with it the concept of a right-of-use asset. With the previous standard IAS 17 this. In order for such a.

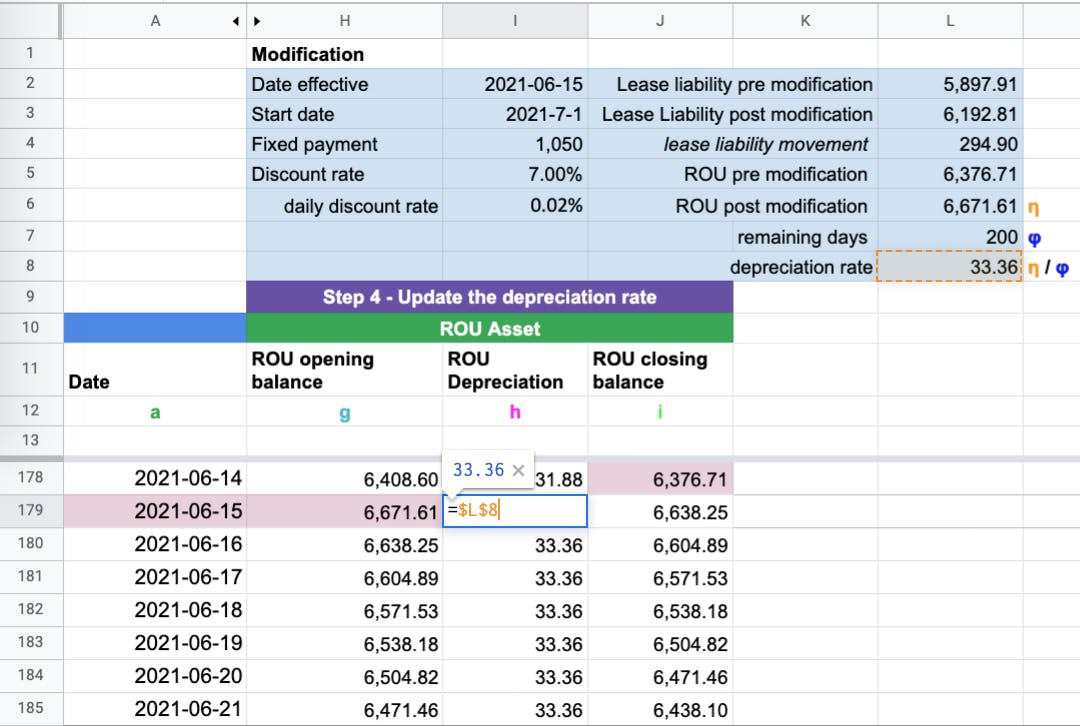

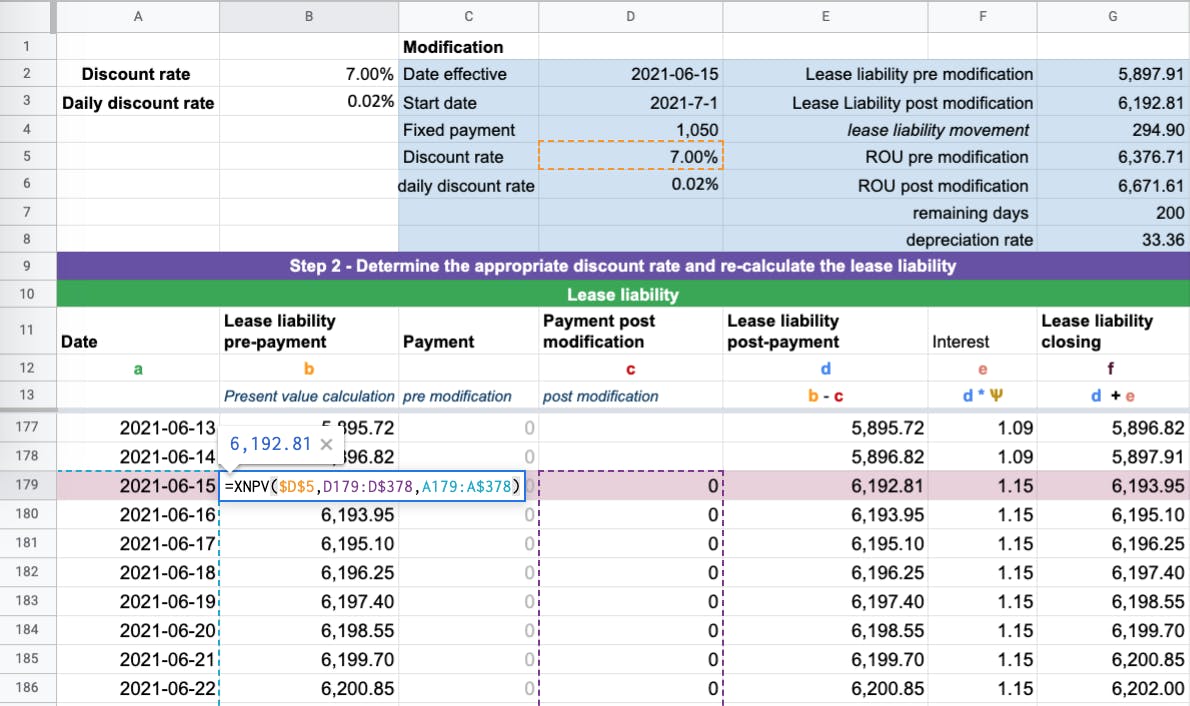

The lease assets or right-of-use assets will need to be depreciated using straight-line depreciation method while on the lease liabilities side interest expense will be recognized. Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. A Calculate the opening balance of the right of use asset and divide by the total number of days the asset will be used.

Under IFRS 16 the entity must recognize a right-of-use asset corresponding to the present value of the lease payments to present value. Faithfully represents lease transactions. If the carrying amount is reduced to zero any further reduction is recognised.

How to amend impairment models for right-of-use assets under IFRS 16. W 10000 of annual lease cost and 7000. IFRS 16 assets.

Provides a basis for users of financial statements to assess the amount timing. Read a summary of IFRS 16 lease accounting with a full example journal entries and an explanation of disclosure requirements. IFRS 16 then specifies how to measure both elements initially and subsequently how to account for remeasurements.

A right-of-use asset is an asset that represents a lessees right to use an underlying asset for the.

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

0 Response to "Right of Use Asset Ifrs 16"

Post a Comment